ESG stands for Environmental, Social and Governance factors - non-financial factors that can have a significant impact on a company's performance and valuation. Environmental factors look at how a company performs as a steward of the natural environment. Social factors examine how it manages relationships with employees, suppliers, customers, and communities. Governance factors scrutinize a company's leadership, executive pay, audits and controls.

While ESG was long seen as a moral imperative, its relevance in business is gaining increasing recognition. Studies show companies with robust ESG standards experience fewer controversies and better financial performance over the long run. They attract talent, win customers who share their values, and gain shareholder support. With consumers and investors prioritizing companies addressing social and environmental outcomes, integrating ESG into strategy and operations has become vital for businesses seeking sustainable growth.

For entrepreneurs, embedding ESG makes commercial sense. It starts them off on the right foot with stakeholders from day one, builds a brand reputation for integrity and responsibility, and enhances their ability to attract talent and investment. Companies seen as committed to ESG tend to be more future-proof, too, as they face fewer regulatory, reputational, and litigation risks down the line. Integrating ESG brings benefits that can last well beyond initial projects or products.

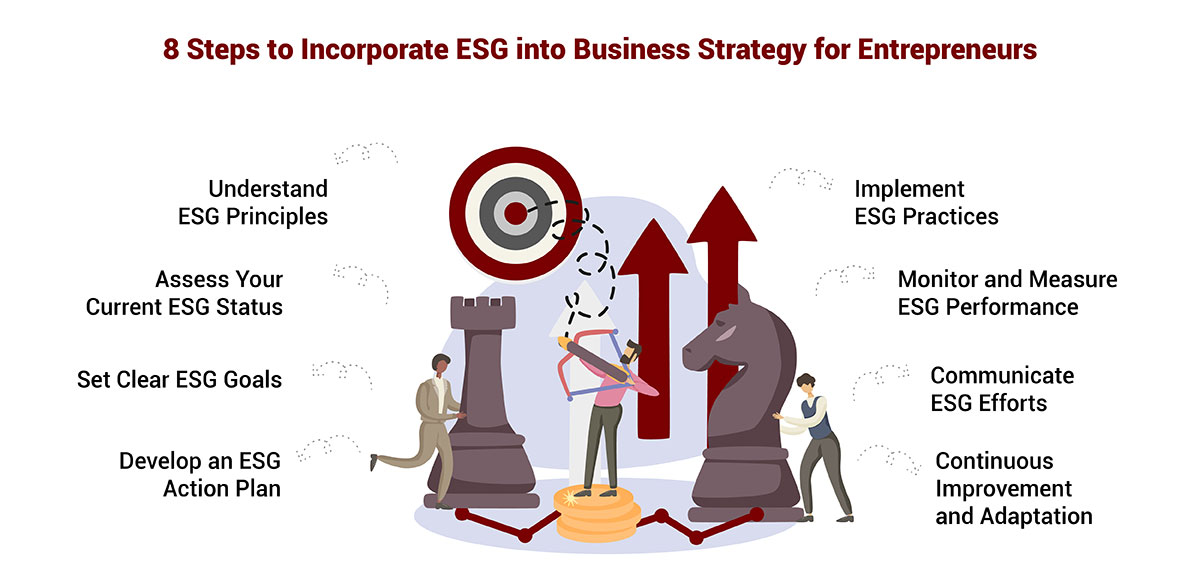

This article provides a step-by-step guide for incorporating ESG principles into your business strategy. It outlines an ESG integration strategy that business leaders can follow to future-proof their operations and position their company for sustainable growth.

Businesses are increasingly recognizing the importance of environmental, social, and governance (ESG) factors in maintaining long-term success.

Entrepreneurs and business strategy professionals can incorporate ESG into their business strategy by following these 8 steps we've written to integrate environmental, social, and governance principles into their operations.

To start their ESG journey, entrepreneurs must first comprehend the core issues behind each dimension.

Environmental concerns include direct impacts like emissions, energy, and water usage in operations and supply chains, as well as indirect effects throughout product life cycles. Social issues examine employment practices, diversity and inclusion, data privacy, customer treatment, and relations with the local community. Governance looks inward at leadership, compensation, transparency, and controls to prevent misconduct.

However, priorities vary by industry. Manufacturing grapples intensely with emissions and resource efficiency. Technology companies focus on data stewardship and responsible innovation. Financial firms ensure products benefit society. Ensuring ESG strategy considers an industry's most material issues enhances relevance and impact. This stage establishes an issue baseline for later steps.

Armed with a context, entrepreneurs should conduct an ESG self-audit examining policies and actions against principles. Gauging performance across environmental, social, and governance topics identifies gaps necessitating change.

Engaging stakeholders provides valuable, objective feedback. Interviews and surveys with all who interact with the business, from investors and employees to purchasers and neighbors, surface impacts overlooked internally plus opportunities for improvement. This phase reveals ESG status from an external viewpoint critical to evolving strategy.

Goals must be Specific, Measurable, Achievable, Relevant, and Time-bound to focus ESG efforts and gauge progress. Objectives should address material issues flagged in assessments and be ambitious yet practical to boost without stretching capabilities.

Aligning ESG targets to a company's vision, mission, and growth strategy anchors them as integral rather than superficial. This interweaves ESG performance intrinsically with commercial aims like brand building, innovation, and sales. Proper setting creates defined aspirations directing the journey.

A roadmap translates goals into actions. It lays out initiatives like renewable energy adoption, diversity hiring programs, or supply chain monitoring over set durations. The plan assigns ownership, deadlines, and resources like budgets, staff time, or equipment to critical projects.

Costs must factor in the long-term. While ESG investments require upfront expenses, they produce ongoing benefits cutting future risks and costs. Determining what financial and human capital is available helps calibrate the plan's scale and schedule for viable execution matching capabilities. Regular reviews keep it agile to a changing landscape.

The tactical work unfolds as initiatives launch. Environmental practices can institute recycling, conserve water in facilities, transition to renewable power purchasing or introduce cleaner production techniques.

Social projects may establish robust diversity hiring processes, expand parental leaves, improve benefits, conduct voluntary community activities, and enhance engagement surveys. Governance work strengthens policies on ethics, conduct, transparency and board oversight of ESG execution.

Piloting high-impact programs before broad rollout allows learning from small-scale testing. Implementation must weigh tradeoffs among objectives to optimize overall ESG performance holistically as advances in one dimension could negatively impact another. Progress hinges on internalizing ESG as ubiquitous, not an add-on task.

Key performance indicators like emissions reduction, employee retention, and supplier audit completion surface what's yielding results. Regular internal reporting factually charts advances, struggles, and lessons. External communication reassures stakeholders of dedication and accountability.

Non-financial data complements traditional economic metrics, giving leadership comprehensive insights into business health and viability. Tracking core issues via KPIs and narratives reveal projects’ actual impacts, and what requires mid-course adjustments or acceleration to stay on goals. It justifies initiatives and builds confidence in the ESG program.

Communications drive further ESG integration by a company's culture and actions. Promoting achievements recognizable to stakeholders shows continuous commitment, builds goodwill and social licenses to operate. Case studies, reports, CSR sections on websites, media interviews, and social media expand outreach.

Leveraging ESG for marketing highlights the benefits employees experience or how products improve lives - resonating with today's conscientious customers. This strengthens brands perceived as trustworthy and progressive. Partnerships amplifying outreach can cultivate networks supporting goals too. Transparency maintains credibility essential to sustainable, values-driven growth.

ESG remains a journey without fixed targets. Periodic feedback from internal and external perspectives via surveys and roundtables aids constant evolution. Emerging global and local challenges plus shifting stakeholder expectations necessitate flexibility and long-term thinking in strategy.

Regulations tighten while reporting standards evolve, necessitating diligence keeping plans current. Pursuing certification demonstrates rigor in moving the agenda forward systematically. Resources must sustain a dynamic cycle of assessment, planning, and accountability delivering lasting social and environmental wins alongside financial strength.

In today’s economy where reputation and responsibility carry weight, ESG is no mere checkbox for entrepreneurs - it is a source of competitive differentiation and resilient success. Companies embracing ESG establish themselves as employers and partners of choice precisely because of their vision and values. Those dismissing its importance risk being left behind.

While the path requires ongoing fortitude, starting the journey today sets a foundation for long-term, inclusive prosperity. By anchoring positive change as the core driver of business, start-ups, and SMEs stand to reap social, environmental, and economic rewards for years to come. Now is the time for entrepreneurs to roll up their sleeves and create impact through innovative, sustainable strategies. The future is theirs to shape for good.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.