The Boston Consulting Group (BCG) Growth-Share Matrix is an exceptional tool that has proven its effectiveness over time. Designed in the early 1970s by the Boston Consulting Group, this matrix has grown to be indispensable for companies looking to properly distribute resources and maintain a balance in their product offerings. We'll explore the fundamentals, applications, and constraints of the BCG Growth-Share Matrix in this blog post, along with providing a real-world example.

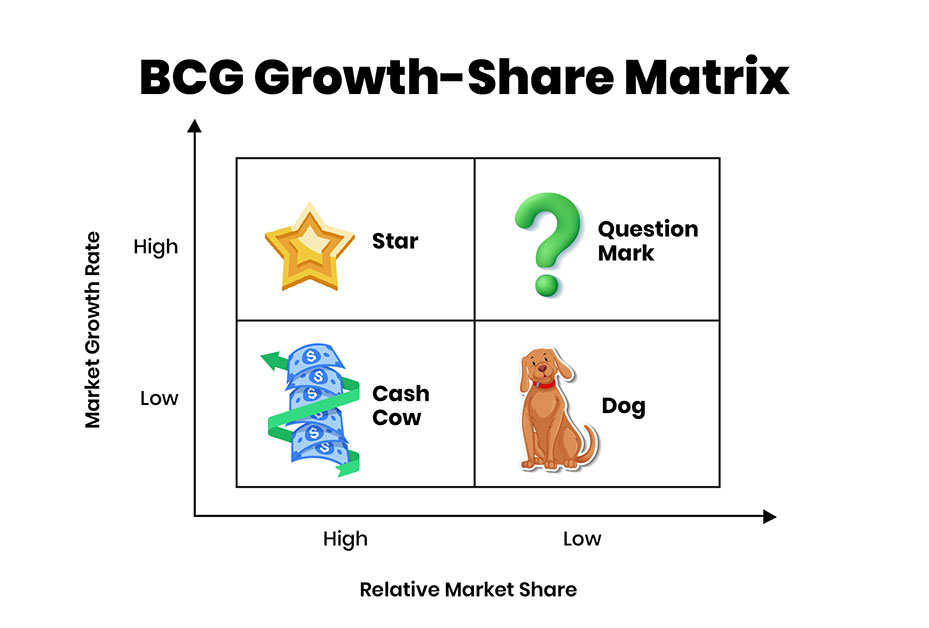

Bruce Henderson, the creator of Boston Consulting Group (BCG), created the Growth-Share Matrix, a strategic framework tool that aids companies in examining their product line. Products are categorized into four quadrants by the matrix based on their market share and growth rate: Stars, Question Marks, Cash Cows, and Dogs. Items with rapid growth and substantial market share are denoted by stars; those with slow growth and minimal share are denoted by question marks; cash cows symbolize high growth and low share; and dogs symbolize low growth and low share. Businesses use the matrix to guide resource allocation and business strategy decisions to optimize their overall profitability and competitiveness in the market.

The BCG Growth-Share Matrix evaluates a company's product portfolio by plotting products on a grid based on market growth and relative market share. It classifies products into four categories:

Thus, the BCG Matrix offers a visual representation of an organization's portfolio, assisting in the formulation of strategic framework choices about the distribution of resources, investments, and divestitures.

Consider the following scenario for a technological company:

An organization's product or business unit portfolio can be visually represented, which helps with resource allocation, investment prioritization, and long-term planning. To guarantee a thorough and flexible business strategy, companies must be aware of the matrix's limitations and utilize it in concert with other business strategy frameworks. The BCG Growth-Share Matrix serves as a trustworthy compass for businesses navigating the intricacies of today's marketplaces, assisting them in setting out on a path toward long-term success and growth.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.