Strategic risk management is a crucial yet often overlooked aspect of long-term business success. While day-to-day risks like operations and finances demand attention, protecting your business strategy from threats is equally important. An effective strategic risk management approach can help you anticipate challenges, make informed decisions, and drive sustainable growth.

This article provides a comprehensive overview of strategic risk management. We'll define what strategic risk means, explore common types of strategic risks businesses face, and discuss a seven-step process for identifying, assessing, and mitigating risks to your strategy. By the end, you'll understand how strategic risk management supports responsible leadership and builds resilience for your business model.

Strategic risk refers to anything that can undermine a company's strategy and jeopardize its goals or very existence. It stems from internal decisions like your business model as well as external forces beyond your control, such as market changes, regulations, or new technologies. Strategic risk management focuses on identifying risks in these areas and developing mitigation strategies.

Without addressing strategic risks, even a well-crafted strategy risks failure. Leaders must think strategically about risk to identify vulnerabilities and build countermeasures into the strategy itself. When managed well, strategic risk helps ensure your business can adapt, innovate, and fulfill its purpose for years to come.

Understanding common strategic risk categories helps leaders recognize threats early and respond appropriately. Here are some frequently encountered strategic risks:

Business Model Risks: Issues with your value proposition, key activities, partner network, customer relationships, revenue streams, or costs could lead customers to seek alternatives.

Competition Risks: Aggressive new entrants, substitute products/services, or shifts in industry rivalry dynamics may challenge your competitive positioning.

Macroeconomic Risks: Changes like recessions, political instability, trade policies, or currency fluctuations could impact customer demand or disrupt supply chains.

Regulatory & Compliance Risks: Evolving laws and regulations may necessitate costly changes to your products, operations or reporting requirements.

Technological Risks: New technologies may disrupt existing business models or create new competitive arenas where first movers gain long-term advantages.

Reputational Risks: Issues like quality problems, data breaches or unethical practices damage customer/partner trust and willingness to engage with your brand.

People & Culture Risks: Difficulties recruiting and retaining key talent or adjusting to new leadership could slow growth plans or spark instability.

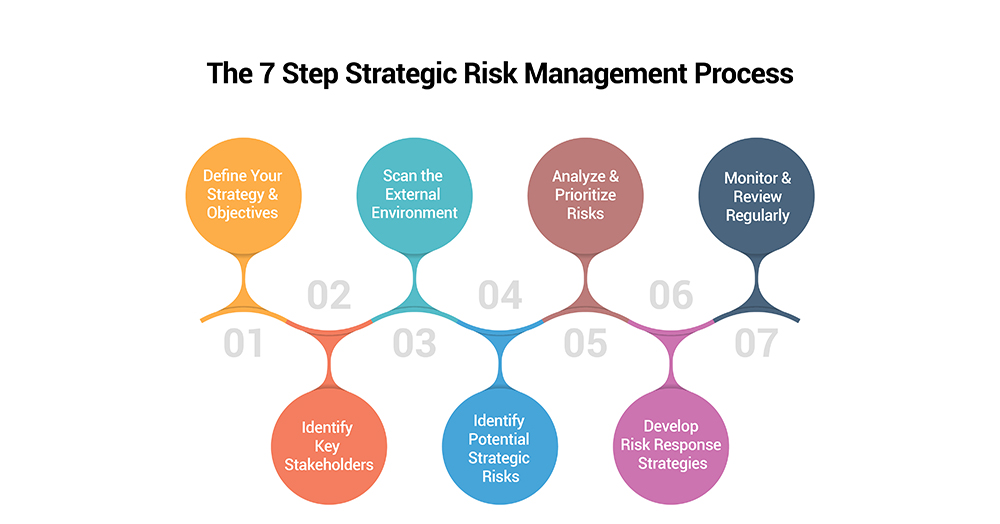

A standardized process helps identify risks that might otherwise go undiscovered and build risk consideration into strategic decision-making. Consider this seven-step framework

1. Define Your Strategy & Objectives

A key first step is clarifying your organization's strategy and objectives. This involves outlining your vision for the future - what do you want to accomplish? It also involves defining concrete goals that will help you achieve your vision. These goals should be specific, measurable, achievable, realistic and time-bound. Along with goals, identify strategic initiatives currently underway that are aimed at supporting your strategy. Having well-defined strategic objectives provides essential context for subsequent risk assessment and response planning.

2. Identify Key Stakeholders

It is important to consider perspectives from both internal and external stakeholders who are important to your organization's success. Internally, gather input from senior leaders, department heads, employees and others responsible for executing your strategic plan. Externally, engage customers, partners, investors and others in your value chain. Understanding stakeholder priorities, pain points and expectations will surface risks lurking in your relationships and reputation. It will also reveal opportunities to further align your strategy with stakeholder needs.

3. Scan the External Environment

A PEST (Political, Economic, Societal, Technological) analysis evaluates macro factors outside your control that could impact your industry and organization. Analyze your competitive landscape to understand threats from rivals. Evaluate demographic shifts and societal trends that may change customer needs over time. Research emerging technologies that could disrupt conventional business models. Monitoring the external environment helps forecast potential challenges on the horizon, allowing proactive risk planning.

4. Identify Potential Strategic Risks

With a strategic context set, brainstorm potential risks to your objectives. SWOT analysis examines internal Strengths and Weaknesses alongside external Opportunities and Threats. Scenario planning imagines how your industry or the world may evolve over 5-10 years under different what-if conditions. List specific events or uncertainties that could derail your strategy, from macroeconomic downturns to product failures to missed market trends. Leave no stone unturned to fully map out plausible vulnerabilities.

5. Analyze & Prioritize Risks

For each risk identified, evaluate its likelihood of occurrence within your planning period. Also estimate the potential negative impact on key metrics like revenue, costs or reputation if the risk materialized. Chart risks onto a heat map according to their rated likelihood and impact. High-priority risks with both high likelihood and large impact warrant urgent mitigation efforts. Medium and low-priority risks still require monitoring and contingency planning.

6. Develop Risk Response Strategies

Create customized response strategies for high-priority risks. Mitigation strategies strengthen resilience by reducing either the likelihood or negative impact through preventative controls. Transfer strategies shift risk through insurance, outsourcing or contracts. Risk avoidance alters plans to sidestep threats altogether. For some risks, acceptance involves contingency planning due to the high costs of other options. Well-defined response plans boost strategic agility.

7. Monitor & Review Regularly

Assign managers to track priority risk indicators and escalate material changes proactively. Formally review the full risk management process annually or as strategic or market realities evolve. Adapt strategies continually based on emergent risks, lessons from previous successes and failures, and progress against objectives. Ongoing monitoring and refinement future-proofs your risk oversight.

This systematic process ensures you address risks proactively rather than reacting to problems. It helps maximize your chances of achieving your strategic objectives and safeguarding long-term success.

To fully realize benefits, strategic risk management must be embedded into your overall strategy development and implementation. Here are some best practices:

Analyze Risks During Planning

When crafting business strategies, organizations should carefully analyze both risks and opportunities that may impact the successful execution of those strategies. Too often, risk management is viewed as a separate compliance exercise done after strategic planning is complete. However, to fully leverage its benefits, strategic risk management must be integrated into the initial strategy formulation process. Leaders should encourage cross-functional teams to have "what if" discussions to surface potential risks during the planning phase. By considering risks upfront, management can make more risk-informed decisions about the designed strategies.

Connect Risks to Objectives

It is also important that any risk assessment conducted is directly tied to the organization's strategic objectives. The risk management process should clearly identify how different risks may threaten the achievement of goals laid out in the strategic plan. With risks connected to objectives, resources can be appropriately allocated to prioritize mitigating those risks that pose the greatest obstacle to key strategic initiatives. Management will have a stronger understanding of how risk exposure may impact performance.

Assign Risk Ownership

For strategic risk management to be effective, there must be a clear allocation of responsibilities. Organizations should delineate who within the business is accountable for monitoring different categories of strategic risk as well as pertinent key risk indicators on an ongoing basis. Assigning risk ownership fosters accountability when it comes to identifying and managing threats that could derail the business strategy.

Engage Leadership

Strong leadership commitment is vital for the successful integration of risk management. Executive sponsors are needed to establish the right culture where risk discussions are welcomed without reprisal. This executive oversight ensures ongoing strategic risk monitoring and mitigation receive sufficient attention across all business operations. Leadership must also support providing appropriate resources for the risk management function.

Use Key Risk Indicators

In addition to traditional key performance indicators, using key risk indicators allows organizations to monitor potential risks in real-time. These leading indicators provide early warning signs to gauge whether identified risks are increasing and if strategies require adjustment. Regular reviews of pertinent KRIs help management remain agile in addressing emerging threats to the business objectives.

Cascade Risk Management

To fully embed strategic risk management, the top strategic risks and ownership must be cascaded down to lower business units and departments. This ensures risk assessment and mitigation activities are incorporated into divisional and functional planning. The cascading approach promotes collaboration across divisions and makes risk management part of day-to-day operations rather than a stand-alone exercise.

Continuously Improve

The strategic risk management process should be seen as iterative rather than static. Organizations must regularly review and update their approach as business strategies and external conditions change over time. Continuous improvement keeps the risk management program aligned with business needs and ensures it remains effective at identifying and responding to new and evolving sources of strategic risk.

This integrated approach makes strategic risk an invaluable part of sustainable strategic management rather than a compliance exercise. It empowers leaders with better visibility into risks inhibiting ambitions and strategies to overcome threats.

Let's consider two examples of how proactive strategic risk management helped well-known businesses succeed despite challenges:

Netflix

In the late 1990s, Netflix saw the threat of online piracy undermining its fledgling DVD rental service. To mitigate the risk and capture emerging opportunities, it innovated an online DVD rental and streaming platform years ahead of competitors. Today it's a global entertainment leader thanks to mitigating technological disruption risks early.

Tesla

As an electric vehicle startup during the global financial crisis, Tesla faced risks of low consumer demand and inability to raise capital. It strategically launched high-end electric Roadster and Model S models to demonstrate technology and generate revenue to fund developing affordable vehicles. Deft risk management helped it survive and transform the automotive industry.

In each case, these companies identified risks to their business models and strategies early. Rather than just trying to minimize threats, they creatively used risks to inform new strategic directions and opportunities. Integrating strategic risk management into their decision-making helped safeguard viability during times of uncertainty.

Strategic risk management supports responsible leadership by enhancing insight into threats and fostering preparedness, resilience and continuous improvement. When embedded into strategy and decision-making, it transforms risk oversight from a compliance exercise into a driver of sustainable growth.

Pioneering companies understand that taking prudent, calculated risks is essential for innovation and adaptation to industry disruption. With the right short and long-term risk management mindset, you can help your business not just survive unforeseen challenges but thrive by turning risks into opportunities. It's a discipline that supports achieving your vision and building a foundation for viability far into the future.

By systematizing how your business identifies, monitors and responds to strategic risks, you empower teams with important context for strategic planning and execution. This integrated approach helps maximize the chances your strategies succeed as intended while safeguarding long-term sustainability and success. Start strengthening your strategic risk oversight today for rewards down the road.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.