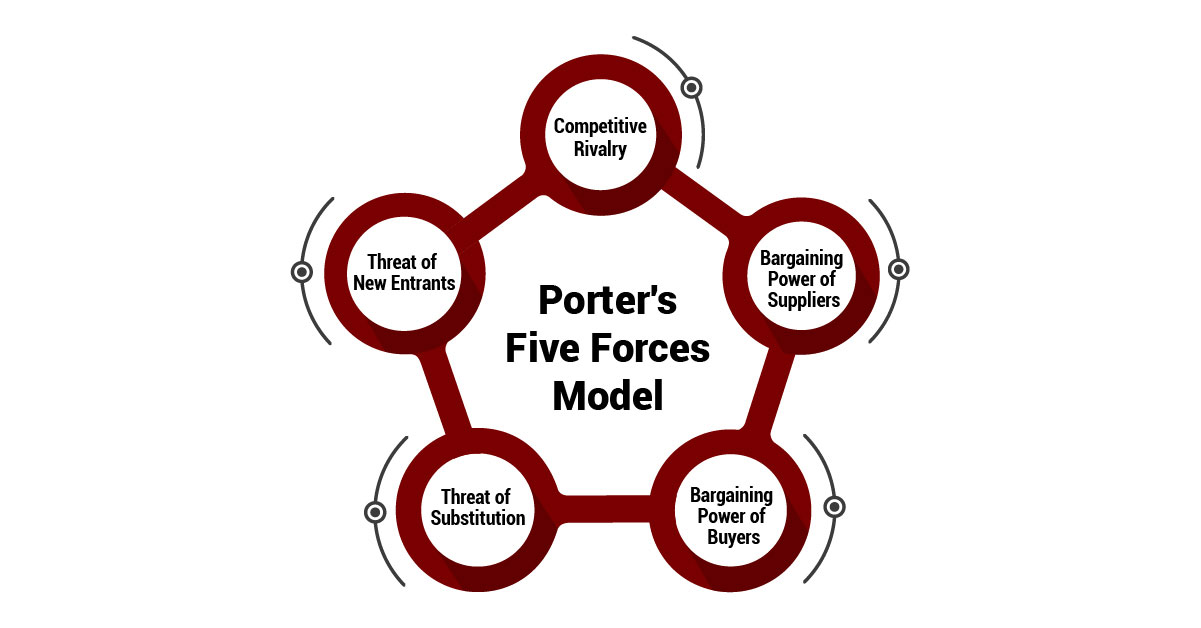

Gaining a competitive edge is vital yet challenging in today’s disruptive business landscape. With cut-throat rivalry and fluid industry boundaries, organizations must continually assess their strategic position to sustain profitable growth. An indispensable strategy framework that helps decode competitive dynamics for actionable insights is Porter’s Five Forces.

Introduced in 1979 by Harvard professor Michael E. Porter, this framework empowers businesses to dissect their industry structure to formulate enduring business strategies. By examining five central competitive forces, companies can identify opportunities, navigate threats, and craft differentiated value propositions.

This article will demystify Porter’s Five Forces, how they affect profitability, real-world examples, and implementation strategies.

Porter’s model examines five key forces that shape the long-term profitability potential of market sectors. By considering the cumulative impact of these forces that pervade industry environments, organizations can devise more resilient positions within competitive landscapes.

Let’s explore each force in-depth.

Arguably the most apparent of Porter’s forces, competitive rivalry refers to jostling between direct competitors vying for a greater share of demand and profits in a given market. The degree of rivalry is dictated by the following:

For example, a sector like restaurants has always attracted intense competition with low entry barriers, similar offerings, and extreme volatility as disposable incomes fluctuate. This creates a perennial fight for customer share and the lifecycle of eateries.

Every business depends on suppliers - vendors, partners, or distribution intermediaries - controlling access to vital inputs from components to labor. Powerful suppliers can squeeze industry profitability by:

Suppliers gain bargaining power from:

Consider the power imbalance between automotive giants and semiconductor chip suppliers. Though automotive is a trillion-dollar industry, chip fabrication for use in vehicles is an oligopoly. With restricted competition and specialization, semiconductor suppliers wield huge influence over automakers as the latter’s manufacturing hinges on timely chip supply despite the overall demand dynamics.

On the other side of a transaction, buyers also pressure companies by demanding reduced prices, premium quality, added services, etc. Buyer power intensifies when:

For instance, big-box retailers like Walmart and Target source such massive volumes that they can negotiate exceptional bulk discounts from consumer goods companies. They then leverage rock-bottom procurement costs towards everyday low pricing that captures mainstream buyers through significant savings. This mutually reinforcing cycle has helped them thrive despite online competition.

All offerings have alternatives - whether identical copies or solutions addressing the same goal through different means. Substitute offerings curb industry profits when they offer greater value along dimensions like affordability, quality, or convenience.

Key drivers of substitution threats include:

For example, digital distribution channels like Netflix and Spotify rapidly replaced physical video and audio rentals through on-demand convenience and lower access costs. Similarly, mobile messaging apps are eroding SMS and email volumes by offering more features for free.

Ever-present across industries, new entrants are drawn towards lucrative sectors. Inbound rivals expand output levels and aim to grab market share, directly affecting incumbent profitability through aggressive tactics.

Factors Dampening the influence of new players are:

Illustratively, the automotive sector has scaled over decades of consolidation and capital investments around manufacturing, design, and distribution. Combined with loyal brand followings and safety regulations, new automaker market entry involves surmounting immense challenges despite competitive dynamics seeming conducive.

This force examination provides a starting point to assess long-term industry attractiveness. Now, let’s see Porter’s framework applied through real-world examples across contexts from higher education and music to retail and transport for deeper insight.

These illustrations across diverse sectors demonstrate nuanced applications of the five forces analysis tailored to respective industry situations.

These examples showcase nuanced analyses needed across industries based on distinct evolving characteristics matching respective competitive conditions and consumer preferences.

Now, we come to business strategy formulation leveraging five forces insights.

After diagnosing competitive forces, the key is responding strategically to industry realities. Famed business strategy guru Michael Porter suggests considering one of three generic approaches to outcompete rivals.

Beyond picking an orientation, executing strategy involves holistic decision-making across management dimensions spanning resource allocation, product mix optimization, partnerships, customer experience, and capability building around the chosen approach.

Most leaders eventually incorporate aspects of all models toward an integrated strategy balancing cost efficiencies, differentiation advantages, and niche specialties for sustainable market outcomes.

While assessing implications from the five forces of scrutiny, be wary of superficial evaluations. Guard against these common pitfalls:

With these precautions and Porter’s framework fundamentals in place, let’s tackle the main criticisms leveled against this legendary construct.

Enduring and insightful, Porter’s model still attracts its share of critiques. Let’s examine the key arguments leveled:

In fairness, Porter himself recognizes criticisms around dynamism, narrowness, and oversimplification. But he underscores that just as underlying human motivations persist over time, industry axioms leading companies to succeed or fail withstand technological shifts or innovation waves affecting near-term competitive mechanics.

Ultimately, the strategy remains contingent on appropriately reacting to prevailing industry forces. Analogous to sailing, unpredictable conditions make a sailor’s skill indispensable regardless of transitory factors like gusts, currents, or tides along any course. Thus, contextual applications and tactical responsiveness hold the keys to five forces.

Despite modern criticisms and limitations, Porter’s Five Forces remains an incisive starting point for informed strategy formulation. Just like medical diagnoses hinged on vital signs tests, sound competitive analysis demands evaluating indicator forces shaping business environments.

Leveraging Porter, leaders can categorize opportunities, anticipate disruptions, and most vitally respond purposefully to profit dimensions controllable by their organizations, not external variables. Mastering Porter’s foundational framework is indispensable for cementing competitive advantage in turbulent times.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.