As a strategic leader driving your business strategy, gaining clarity into your internal capabilities and external environment is crucial for growth and staying competitive. Strategic analysis serves as that vital step that paves the path for data-driven planning.

This guide will equip you with a 360-degree view of what strategic analysis entails. Let’s get started!

Strategic analysis refers to the process of thoroughly evaluating an organization’s internal and external environments to formulate an effective business strategy. It empowers business leaders to identify opportunities, trends, and potential threats to address.

Instead of relying on assumptions, strategic analysis leverages qualitative and quantitative data to provide contextual insights for shaping business strategy.

When conducting a strategic analysis, a business strategist employs different approaches to evaluate the factors influencing their operations. The two main types are:

01. Internal Strategic Analysis

An internal strategic analysis focuses inwards on the organization’s current state. It helps reveal strengths, weaknesses, capabilities, and resources. Common tools used include Gap analysis, SWOT analysis, and Value Chain analysis.

02. External Strategic Analysis

External analysis scans the operating environment outside your business. It captures potential opportunities, emerging trends, risks, competitor landscape, and other external factors that impact strategy. PESTLE analysis and Porter’s Five Forces analysis help assess opportunities and threats.

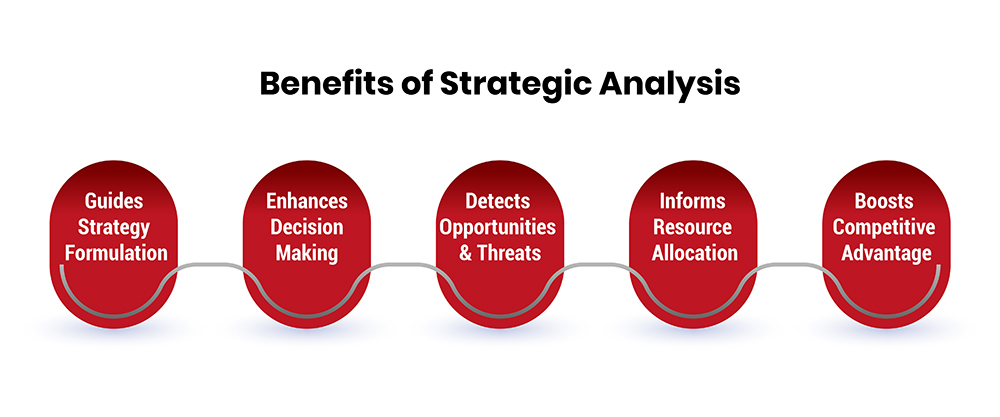

Here are five key ways strategic analysis powers business strategy and decision-making:

Conducting a structured strategic analysis provides the critical insights and information needed to formulate realistic, achievable strategic plans. By thoroughly analyzing the internal and external environments, companies can identify their core strengths and weaknesses, detect potential opportunities and threats, and understand market dynamics and competitive forces.

Armed with these evidence-based findings, leaders can devise strategies and set goals that align with organizational capabilities and market realities. Rather than making assumptions or guesses, the strategy is shaped by factual data and trends. This results in strategic plans that leverage organizational strengths, address weaknesses, capitalize on chances for growth, and counter external threats.

Strategic analysis empowers leaders to make reliable, data-driven decisions rather than intuition-based choices. By researching market conditions, customer needs, industry trends, and internal operations, companies can base choices on facts rather than assumptions.

Leaders can confidently decide where to allocate resources, which initiatives to pursue, when to expand capacities, and how to counter competitors with strategies grounded in research rather than guesswork. Backed by hard evidence, decisions mitigate risk and drive growth.

A thorough strategic analysis uncovers potential opportunities for innovation and growth while revealing lurking threats even before they fully materialize. By understanding customer needs, market gaps, emerging technologies, regulatory changes, and competitor moves, companies can get a first-mover advantage and prepare contingency plans.

Rather than getting caught off guard by disruption, leaders can make preemptive moves to capture value and defend market share. Spotting changes and trends early allows for agility.

Strategic analysis highlights where resources need to be focused, reassigned or added to pursue goals and strategic objectives. Leaders can see which business units or initiatives warrant funding based on growth potential, which operations need optimization, and where capacities should be expanded or trimmed.

Backed by data, executives can strategically allocate human, financial and operational resources to fuel expansion, efficiency and competitiveness. The analysis connects the dots between strategies and required resourcing.

By benchmarking against rivals, strategic analysis reveals an organization’s competitive strengths and weaknesses compared to key players. Companies can then formulate strategies that fully leverage differentiating strengths while addressing gaps that may put them at a disadvantage.

The analysis also sheds light on what competitors are doing, allowing organizations to respond with counter moves, innovations and enhanced value propositions to get a strategic edge. Deriving competitive intelligence from analysis fosters an organization's overall strategic positioning.

Let’s see a real-world example of a strategic analysis in action. Here is an excerpt looking at retail giant Walmart:

A PESTLE analysis may reveal the following:

Economic factorslike recession leading to consumers saving money and buying discounted items plays into Walmart’s focus on EDLP (everyday low prices).

Rising use of mobile apps & digital payments (technological factors) align with Walmart’s app and Scan & Go feature.

Health consciousness trend (sociocultural factor) shows an opportunity to expand grocery & organic offerings.

A SWOT analysis may highlight strengths like its vast physical & distribution network, financial clout, brand recognition, and growing ecommerce presence. Weaknesses may include negative brand perception and low profit margins.

These findings would inform initiatives like localized assortments, private brands, better customer experience, and so on.

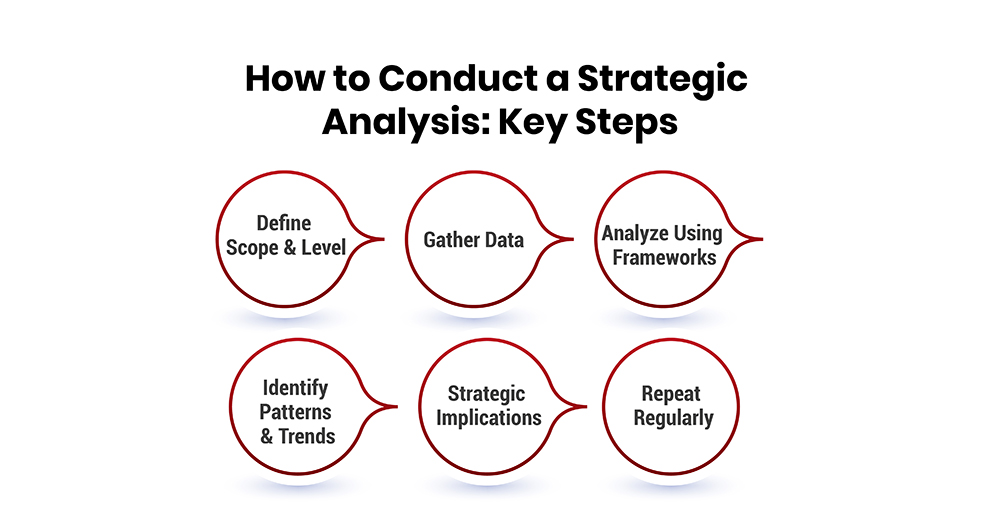

Now that you’re convinced of the immense value of strategic analysis for shaping strategy, let’s explore how to carry out this process successfully.

The first step is to clearly define the scope and level of the strategic analysis. Determine which part of the business you are analyzing - is it the entire organization, a specific business unit, or a department? Next, define what level of strategy the analysis will inform. There are typically three levels:

Corporate Strategy - guides the overall direction of a diversified organization with multiple business units.

Business Strategy - focused on how to compete in a particular industry or market.

Functional Strategy - focused on maximizing efficiency and effectiveness of a specific organizational function (e.g. marketing, HR).

Clarifying the scope and level sets the stage for an analysis that will provide relevant insights.

With the scope defined, start gathering data from both internal and external sources to build an accurate, holistic picture. Conduct research using internal data sources such as financial statements, performance metrics, customer insights as well as external sources like industry reports, market projections from analysts, and expert consultations.

Both qualitative and quantitative data are needed to enable meaningful analysis. Cast a wide net to capture all information that can impact your strategic priorities.

With data gathered, start analyzing it using strategic analysis frameworks and tools like SWOT analysis, PESTEL framework, Porter's Five Forces model etc. Pick tools that are relevant to your specific business and strategic questions. Thoroughly analyze data to uncover insights that impact long-term strategic planning.

Now look for recurring themes and make connections between different data points. Spot patterns and trends among your findings that highlight strengths to leverage, weaknesses to improve, opportunities to capture and threats to mitigate.

Next determine the strategic implications of your analysis in terms of strategic priorities, growth opportunities, new initiatives, and resource allocation. Make recommendations on how the external and internal environment should influence strategy setting.

Set a consistent cadence, such as annually, to redo your strategic analysis and track how the business context is evolving over time. This builds institutional knowledge and gives strategy setting an external orientation. Periodically updating the strategic analysis is key to keeping strategy dynamic.

In the analysis phase, leverage proven strategic analysis frameworks. Here are four options to choose from:

A SWOT analysis is a framework used to evaluate the strengths, weaknesses, opportunities, and threats involved in a project or venture. It involves specifying the objective of the project or venture and identifying the internal and external factors that are favorable and unfavorable to achieving that objective.

Strengths are characteristics of the project that give it an advantage over others. These could include a strong brand, loyal customer base, cost advantages, unique technology, etc. Weaknesses are characteristics that place the project at a disadvantage relative to others. These could be lack of marketing expertise, high cost structure, lack of access to distribution channels, etc.

Opportunities are elements in the environment that the project could exploit to its advantage. These could include arrival of new technologies, loosening of regulations, removal of international trade barriers, etc. Threats are elements in the environment that could cause trouble for the project. These could include entrance of low-cost competitors, adverse demographic changes, adverse regulatory changes, etc.

By identifying strengths, weaknesses, opportunities and threats, a SWOT analysis helps develop an effective strategy by building on strengths, eliminating weaknesses, exploiting opportunities and mitigating threats.

PESTLE is an analytical framework used to evaluate how different external political, economic, social, technological, legal and environmental factors impact an organization and its strategy. Specifically, it involves evaluating how each of these factors will affect the organization in the future.

Political factors include government policies, political stability, tax policies, trade restrictions, etc. that may impact the organization and how it operates.

Economic factors include economic growth rates, interest rates, exchange rates, inflation rates, disposable income of consumers, business cycles, etc.

Social factors include cultural trends, population analytics, income distribution, health consciousness, career attitudes, etc.

Technological factors include innovations, access to technology, intellectual property issues, technology incentives, etc.

Legal factors include discrimination laws, consumer laws, antitrust laws, employment laws, health and safety regulations etc.

Environmental factors include climate, weather, geographical location, global changes in climate, environmental offsets etc.

By considering all these external factors and how they will impact the organization in the future, a PESTLE analysis helps identify blind spots and areas of opportunity that could otherwise be overlooked. It provides an overview of the whole environment an organization operates in.

Porter's five forces framework is a strategic analysis tool that is used to analyze the level of competition within an industry and develop a business strategy accordingly. The framework analyzes the competitive forces along five dimensions:

Competitive rivalry: This refers to the number of competitors and their ability to threaten your market share. A high number of competitors signals higher rivalry.

Bargaining power of suppliers: This refers to how much bargaining power your supplies have over you in your industry. Powerful suppliers can increase prices or reduce quality.

Bargaining power of buyers: This refers to how much bargaining power your customers have over you. Customers with significant buying power can demand lower prices or higher service quality.

Threat of substitute products: This refers to availability of products that can serve as substitutes to your product. High availability indicates a greater threat.

Threat of new entrants: This refers to how easy or difficult it is for new competitors to enter your market. Easier entry means new competitors can alter competitive dynamics.

By analyzing these five forces, Porter's framework aims to achieve competitive advantage by developing strategies around opportunities and threats within an industry. It provides insights into profitability and risks to better understand industry competition.

A gap analysis involves studying the gap between an organization’s actual performance vs its potential performance. Gap analysis begins with defining the organization’s desired future state and comparing it against the present state of the organization along key performance metrics.

The gaps along different metrics highlight areas for potential improvement. After identifying gaps, strategies and action plans can be developed and implemented to close or narrow those gaps so that the organization's actual performance approaches its potential.

Some examples of gaps could be gap between current sales revenue vs projected revenue, current customer satisfaction score vs target score, current staff productivity vs benchmark productivity etc. Gap analysis provides a foundation for measuring actual performance improvements against previously set targets. It facilitates goal-setting by highlighting internal issues and areas for improvement.

With a plethora of strategic analysis tools available, it can get overwhelming to select the right framework that aligns with your objectives. The key is to have a clear purpose behind doing the analysis and match it with a technique that provides the required breadth and depth of insights.

Here are four criteria to help you choose the appropriate strategic analysis tool:

Technique aligns to analysis objective

Be very clear on why you are doing the analysis and what questions you want answered. This will help you pick a framework that directly serves that objective.

For instance, if your purpose is to evaluate new market opportunities, tools like PESTLE and Porter’s Five Forces which scan the external environment will be more suitable. On the other hand, if you want to assess internal capabilities, VRIO analysis and McKinsey 7S model would be better fits.

Set the right expectations on what each tool can deliver so there are no surprises or disconnected outputs.

Tool suits your analysis scope

Your choice of tool should match the scope of your strategic analysis whether it is Corporate strategy, Business strategy, or Functional strategy.

For corporate strategy, tools like Gap analysis and Four Corners analysis take a broader approach in line with the extensive scale of impact.

Whereas for functional strategies, Value Chain Analysis breaks down activities into granular detail to inform specific capabilities and processes needing improvement.

Relevant to your industry/business model

While some basics hold true across sectors, each industry has its unique intricacies. The tool you choose should help you effectively navigate the distinct landscapes.

For a heavily regulated industry like Banking or Pharma, PESTLE analysis works well to monitor legal and political factors. Technology firms rely more on tracing disruption with frameworks like Four Corners.

Look for techniques specially designed for your industry or ones that have proven relevance based on industry research. This ensures meaningful and actionable outputs.

Output enables decision-making for next steps

The real test of an effective strategic analysis lies in its ability to shape your strategic decisions. The tool should equip you with insights to:

Spot potential risks/opportunities

Identify capability gaps

Recognize changing industry dynamics

Re-evaluate business partnerships

Rethink competitive positioning

And most importantly, prioritize specific actions whether it is reconfiguring resources, adding new metrics or acquiring expertise.

If the tool’s output does not link clearly to decisions, reassess your choice to find one that does. The key is not to go overboard with too many tools that it becomes unproductive. Be selective in using a mix of 2-3 compatible tools that holistically address your analysis needs.

While vital, analysis itself does not enable change. Transformed insights need structured execution. That’s where a dedicated strategy execution platform becomes invaluable.

It breaks down strategy to connect vision with execution via objectives, strategic initiatives, and key results while monitoring performance. This bridges the strategy analysis-execution gap with clarity for people and teams.

So harness the power of analysis, then activate the insights distilled through robust delivery mechanisms to turn strategy into action.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.