Diversification isn't just a fancy word that businesses use to impress their shareholders. It's a powerful strategy that can help them avoid putting all their eggs in one basket. Imagine you're a restaurant owner, and all you serve is pizza. Sure, people love pizza, but what if a new health craze sweeps the nation, and suddenly everyone wants vegan sushi instead? By diversifying your menu, you can hedge your bets and make sure that your business isn't left behind. In this article, we'll explore the world of diversification strategies and how they can help businesses stay ahead of the curve.

A diversification strategy can take various forms, the strategy often involves entering into new markets or product lines that are different from the company's current core business. For instance, a company that specializes in manufacturing televisions may choose to diversify by entering into the smartphone market. This way, the company reduces the risk of relying solely on the television market and can capitalize on the growing smartphone market.

Diversification strategy can be accomplished in different ways. One approach is through mergers and acquisitions. Companies may acquire other businesses in different industries or markets that complement their existing operations. For instance, a company that produces soft drinks may acquire a company that manufactures snack foods, allowing them to diversify their product portfolio.

Another approach is to develop new products or services that are complementary to the company's existing offerings. For example, a software company that specializes in customer relationship management (CRM) software may choose to develop a project management software that can integrate with their existing CRM.

Diversification strategy is essential for businesses for several reasons. Firstly, it ensures that a company's revenue streams are not tied to a single product or service. Thus, a business that experiences a decline in sales in one area may still generate revenue from other areas.

Secondly, diversification strategy enables businesses to take advantage of new opportunities. By entering into new markets or product lines, businesses can capitalize on emerging trends and generate new revenue streams. For instance, a company that diversifies into renewable energy can capitalize on the growing demand for green technology.

Thirdly, diversification strategy can help businesses achieve economies of scale. By leveraging existing resources, such as manufacturing facilities, distribution channels, and customer base, businesses can reduce costs and increase profitability.

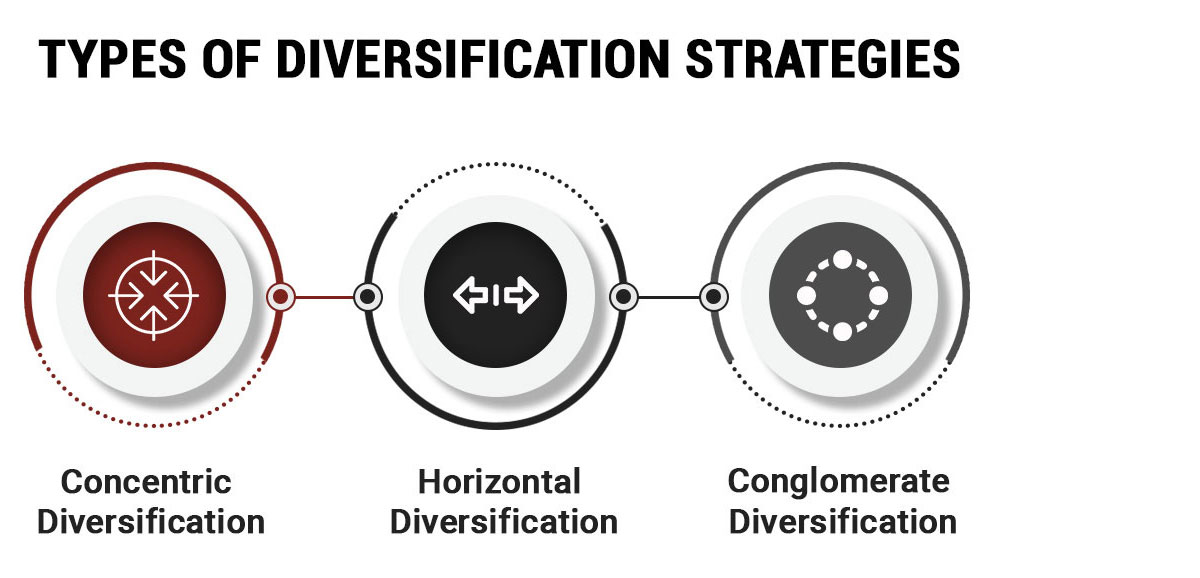

As a business strategist, it is important to understand the different types of diversification strategies and how they can be used to benefit a business. It is a common growth strategy used by companies to spread out their operation with the goal of expansion.

There are three primary types of diversification strategies:

Overall, diversification strategies can help businesses achieve growth and reduce risk. It is important for business strategy professionals to carefully consider the potential costs and benefits of each type of diversification strategy before making any significant investments, and to work with a team of experts to develop a comprehensive diversification plan that aligns with the business's goals and resources.

Diversifying your business can offer numerous benefits, such as:

While diversification can offer numerous benefits, it also comes with its own set of challenges. One of the most significant challenges is the risk of spreading your resources too thin. Diversification requires significant investments of time, money, and other resources, which can strain your existing operations. It's essential to carefully consider the potential costs and benefits of diversification before making any significant investments.

Another challenge is the risk of losing focus on your core business. Diversification can be tempting, but it's essential to ensure that your existing operations remain your top priority. If you spread your resources too thin, you may risk neglecting your core business, which can lead to a decline in sales and profitability.

Many successful companies have used diversification strategies to grow their operations and stay ahead of their competitors. Here are a few examples:

Amazon's diversification strategy involved expanding its business from being an online bookstore to offering a wide range of products and services, including cloud computing, streaming media, and online retail. Amazon's strategy was to build a customer-centric business model that leverages technology to deliver convenience, selection, and value to customers. This strategy involved investing in new technologies and services that would enhance the customer experience, such as Prime, Amazon Web Services, and Amazon Prime Video. By diversifying its operations, Amazon was able to increase its revenue streams and grow its customer base, while reducing its dependence on any one product or service.

Disney's diversification strategy was based on expanding its entertainment empire by leveraging its brand and content across multiple platforms. Disney's strategy involved acquiring companies and assets that would enable it to create new revenue streams and enhance its competitive advantage. For example, Disney acquired ESPN, Pixar, Marvel, and Lucasfilm to expand its portfolio of brands and intellectual property. Disney also diversified its business by entering new markets, such as consumer products, theme parks, and media networks. By diversifying its operations, Disney was able to create a powerful brand that is recognized and loved by consumers around the world.

Samsung's diversification strategy involved leveraging its expertise across multiple industries to create new opportunities for growth and innovation. Samsung's strategy was to build a portfolio of businesses that complemented each other and provided synergies. Samsung diversified into electronics, finance, and construction, and invested heavily in research and development to drive innovation and create new products and services. By diversifying its operations, Samsung was able to reduce its dependence on any one business, and create a more stable and sustainable business model.

In summary, successful companies use diversification as a tool to achieve growth, reduce risk, and stay ahead of their competitors. Their diversification strategies are based on identifying new opportunities, leveraging their core competencies, and creating synergies across their businesses. By diversifying their operations, these companies have been able to enhance their competitive advantage, build powerful brands, and create value for their stakeholders.

Q - What is the difference between related and unrelated diversification?

A - Related diversification refers to the strategy of expanding a business by entering into a new market or product line that is related to the existing business. Unrelated diversification refers to the strategy of entering into a new market or product line that is unrelated to the existing business.

Q - Is diversification always a good strategy?

A - Diversification can offer many benefits, but it is not always a good strategy. Diversification requires significant investments of time and resources, and it can also be risky. It's important to carefully consider the potential costs and benefits of diversification before making any significant investments.

Q - How can I determine if diversification is the right strategy for my business?

A - There is no one-size-fits-all answer to this question. It's important to carefully evaluate your business's goals, resources, and capabilities to determine if diversification is the right strategy for you. You may want to consider working with a consultant or advisor who can help you evaluate your options and make an informed decision.

Q - Can diversification help me stay ahead of my competitors?

A - Yes, diversification can help you stay ahead of your competitors by enabling you to offer unique value propositions to your customers. By expanding your product portfolio or entering into new markets, you can differentiate your business from your competitors and capture market share.

Q - What are the risks of diversification?

A - The risks of diversification include spreading your resources too thin, losing focus on your core business, and entering into markets or product lines that may not be profitable. It's important to carefully evaluate the potential costs and benefits of diversification before making any significant investments.

Diversification is like trying to juggle multiple balls at the same time. It's a tricky balancing act that businesses use to expand their operations and explore new opportunities. By diversifying their portfolio, businesses can spread their risk across different markets and products, like a skilled juggler who can keep multiple balls in the air at once.

But just like juggling, diversification can be challenging. It requires a delicate touch and a keen eye for timing. However, when done right, diversification can be a powerful tool that helps businesses achieve economies of scale and capitalize on new opportunities. Like a skilled juggler who wows the crowd with their impressive tricks, businesses that master the art of diversification can achieve long-term growth and success.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.